Welcome, dear reader! Have you ever heard of AIG structured settlements before? If not, don’t worry, we’re here to break it down for you in simple terms. AIG structured settlements are financial arrangements that provide a series of payments to an individual who has received a settlement as a result of a legal claim or dispute. These structured settlements are often used in cases of personal injury, medical malpractice, or wrongful death, among others. Let’s dive deeper into the world of AIG structured settlements and understand how they work.

What are AIG Structured Settlements?

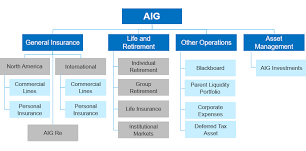

Structured settlements are a way for individuals to receive compensation for a personal injury or other legal claim over a period of time, rather than in a lump sum. AIG, or American International Group, is a leading provider of structured settlements, offering a range of options for those looking to secure their financial future.

With an AIG structured settlement, the recipient receives regular payments over a predetermined period, providing a steady stream of income to cover expenses such as medical bills, living costs, or other financial needs. These payments can be tailored to the individual’s specific requirements, ensuring that their financial needs are met now and in the future.

One of the key benefits of an AIG structured settlement is the security it provides to the recipient. By receiving payments over time, rather than in a lump sum, individuals can better manage their finances and ensure they have a reliable source of income for years to come. This can be especially important for those who may be unable to work due to their injury or who need ongoing medical care.

Another advantage of AIG structured settlements is the flexibility they offer. Recipients can choose from a variety of payment options, including fixed or variable payments, as well as different payment frequencies. This allows individuals to tailor their settlement to meet their specific needs and preferences, ensuring they have the financial support they require.

In addition to providing financial security and flexibility, AIG structured settlements also offer tax advantages to the recipient. In many cases, the payments received through a structured settlement are tax-free, providing additional financial benefits to the individual. This can help to reduce the overall tax burden on the recipient and ensure they can make the most of their settlement funds.

Overall, AIG structured settlements are a valuable option for individuals looking to secure their financial future after a personal injury or legal claim. With their security, flexibility, and tax advantages, structured settlements can provide peace of mind and financial stability to those in need. If you are considering a structured settlement, be sure to explore the options offered by AIG and consult with a financial advisor to determine the best choice for your individual circumstances.

Benefits of Choosing an AIG Structured Settlement

When it comes to receiving a structured settlement, it is essential to choose a reputable and reliable company like AIG. There are several benefits to opting for an AIG structured settlement, and we will discuss some of them in detail below.

One of the primary advantages of choosing an AIG structured settlement is the financial security it provides. AIG is a well-established and highly trusted company with a proven track record of delivering on its promises. When you enter into a structured settlement agreement with AIG, you can have peace of mind knowing that your future payments are secure and will be paid out as agreed upon.

Additionally, AIG offers a wide range of flexible payment options to meet your specific needs. Whether you prefer to receive monthly, quarterly, or annual payments, AIG can tailor a payment schedule that works best for you. This flexibility allows you to better manage your finances and plan for the future with confidence.

Furthermore, AIG structured settlements come with tax benefits that can help you save money in the long run. In many cases, the payments you receive from a structured settlement are tax-free, providing you with a significant financial advantage over receiving a lump sum settlement. This tax-free status can make a big difference in the amount of money you ultimately receive from your settlement.

Another key benefit of choosing an AIG structured settlement is the peace of mind that comes from working with a reputable company. AIG has a strong reputation for delivering excellent customer service and support, ensuring that you have a positive experience throughout the settlement process. Their team of experts is dedicated to helping you understand your settlement options and assisting you in making informed decisions about your financial future.

Lastly, choosing an AIG structured settlement can provide you with a sense of financial stability and security for years to come. With regular payments from AIG, you can rest assured that you will have a reliable source of income to support your needs and goals. Whether you are looking to pay off debt, cover living expenses, or save for the future, an AIG structured settlement can help you achieve your financial objectives.

How AIG Structured Settlements Work

Structured settlements offered by AIG are designed to provide financial security and stability for individuals who have received a large sum of money from a legal settlement or other means. These settlements are typically used in cases where the recipient has suffered a serious injury or illness and will require long-term financial support. A structured settlement allows the recipient to receive regular payments over a specified period rather than a lump sum payment all at once. This helps ensure that the individual has a steady stream of income to cover medical expenses, living costs, and other financial needs.

When AIG sets up a structured settlement, they work closely with the recipient and their legal team to determine the specific payment schedule and amounts that will best meet the recipient’s needs. This process involves evaluating the recipient’s current and future financial obligations, as well as any potential future expenses related to their injury or illness. Once the payment schedule is established, AIG will then purchase an annuity from a reputable insurance company to fund the structured settlement. An annuity is a financial product that provides a guaranteed stream of income over a set period, so the recipient can rely on these payments for the duration of the settlement.

One key advantage of AIG structured settlements is the flexibility they offer to recipients. In some cases, the recipient may have the option to customize their payment schedule to better align with their financial goals. For example, they may choose to receive larger payments in the initial years to cover immediate medical expenses or other pressing financial needs, with smaller payments in subsequent years. Alternatively, the recipient may opt for equal payments over the entire period of the settlement. This level of customization allows individuals to tailor their structured settlement to their unique circumstances, ensuring that their financial needs are met over the long term.

In addition to providing financial stability, AIG structured settlements also offer tax advantages to the recipient. Under current tax laws, the income received from a structured settlement is typically tax-free, making it an attractive option for individuals looking to maximize their financial resources. This tax-free status applies to both the principal amount and any interest earned on the annuity, providing the recipient with additional financial security.

Overall, AIG structured settlements are a valuable tool for individuals seeking long-term financial stability in the wake of a serious injury or illness. By providing a steady stream of income over a specified period, along with the flexibility to customize payment schedules, these settlements help ensure that recipients can meet their financial needs and maintain their quality of life. With the added tax advantages, AIG structured settlements offer a compelling solution for individuals looking to secure their financial future.

Tax Implications of AIG Structured Settlements

When it comes to structured settlements offered by AIG, there are important tax implications to consider. Structured settlements are typically used to provide long-term financial security for individuals who have been injured or wronged due to negligence. These settlements are often paid out over a period of time, rather than in one lump sum. This can have significant tax benefits for the recipient.

One key advantage of structured settlements is that the payments are typically tax-free. This means that the recipient does not have to pay income tax on the money they receive from the settlement. This is in contrast to other types of income, such as wages or investment earnings, which are usually subject to income tax.

Another benefit of structured settlements from a tax perspective is that the payments can be structured in a way that minimizes the recipient’s tax liability. For example, the payments can be spread out over many years, which can help the recipient stay in a lower tax bracket and reduce the overall amount of tax they owe.

It is important to note that the tax treatment of structured settlements can vary depending on the specific circumstances of the case. For example, if the settlement is being paid out as compensation for physical injuries or sickness, the payments are typically tax-free. However, if the settlement is for other types of damages, such as emotional distress or lost wages, the tax treatment may be different.

It is always a good idea to consult with a tax advisor or financial planner when considering a structured settlement from AIG. They can help you understand the tax implications of the settlement and make the best decisions for your financial future.

Factors to Consider When Deciding on an AIG Structured Settlement

When deciding on an AIG structured settlement, there are several important factors to take into consideration to ensure that you are making the best decision for your financial future. Here are five key factors to keep in mind:

1. Financial Goals: Before deciding on an AIG structured settlement, it is essential to assess your financial goals and objectives. Consider whether you are looking for a consistent stream of income over a certain period or a lump sum payment. Understanding your financial goals will help you determine the most suitable structured settlement plan for your needs.

2. Tax Implications: Another crucial factor to consider when deciding on an AIG structured settlement is the tax implications. Structured settlements can offer tax advantages, such as tax-deferred payments, which can result in significant savings over time. It is important to consult with a financial advisor or tax professional to understand how a structured settlement may impact your tax situation.

3. Financial Stability of the Insurer: It is important to consider the financial stability and reputation of the insurer offering the structured settlement. AIG, as a well-established and reputable company, can provide you with peace of mind knowing that your payments are secure. Research the insurer’s financial ratings and history to ensure that they are a reliable and trustworthy provider.

4. Flexibility of Payment Options: When choosing an AIG structured settlement, it is essential to consider the flexibility of payment options available. Some structured settlement plans may allow for changes in payment schedules or the option to receive a lump sum payment in certain circumstances. Evaluate the payment options offered by AIG to determine if they align with your financial needs and preferences.

5. Inflation Protection: One important factor to consider when deciding on an AIG structured settlement is whether the plan includes inflation protection. Inflation can erode the purchasing power of your future payments, so it is crucial to choose a structured settlement that offers some form of inflation protection. This can help ensure that your payments keep pace with the rising cost of living and maintain their value over time.

In conclusion, when deciding on an AIG structured settlement, it is essential to consider factors such as your financial goals, tax implications, the insurer’s financial stability, payment options, and inflation protection. By carefully evaluating these factors, you can make an informed decision that aligns with your financial objectives and provides you with long-term financial security.